Reviews

Plus500 Review

Plus500 is an interesting cfd broker that is offering access to thousands financial products and is active on the FX, commodities, indices and options market.

A good broker is offering as many financial instruments possible in order to offer a diversified trading dashboard to its clients and to attract new ones as well. This way the clients base is rising and trading is more active. Plus500 has one of the biggest offerings in the market as besides the classical currency pairs, trading can be done on ETF’s, CFD’s, indexes, commodities, and many other asset classes.

Regulation

Plus500 is a leading online trading provider established in 2008 and it is regulated in Cyprus by the Cyprus Securities & Exchange Commission – CySEC. On top of that, regulation is also provided by FCA (Financial Conduct Authority) in the United Kingdom as well as ASIC (Australian Securities & Investments Commission) in Australia.

Regulation is important when it comes to a forex broker as it builds trust among traders and this matters the most when it comes to choosing a broker to trade with. A broker should be viewed as a trader’s partner as the broker makes money from commissions while the trader from forecasting future prices and trading on that belief.

Plus500 Trading Platforms

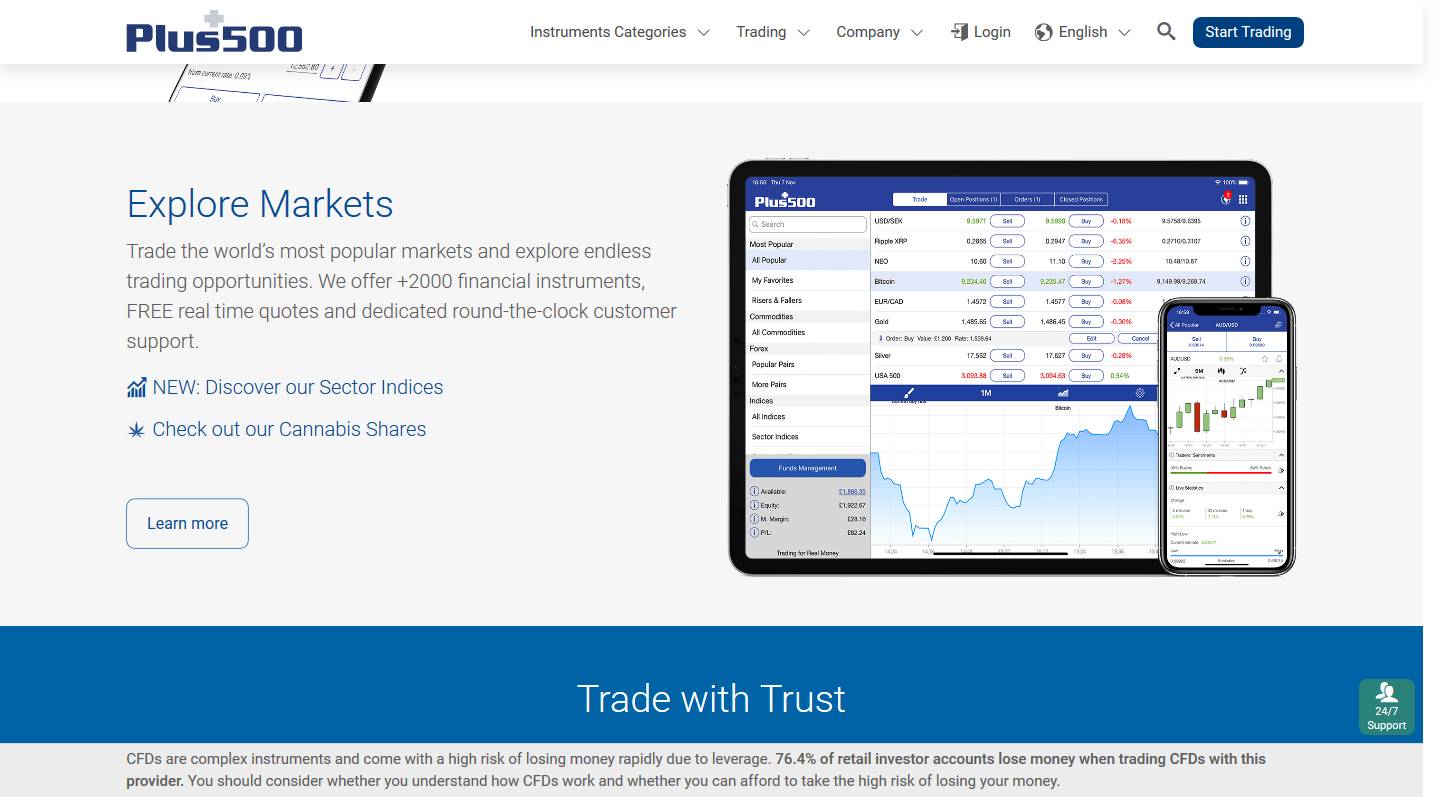

Access to a trading account can be made via web trader (this is important as no downloads are needed, a simple Internet connection will do the trick) and there are versions of it for Windows, Linux, Android & more. The most popular trading platform, Metatrader, is not offered here, and maybe this is a drawdown, but the fact that the web-based trading platform is represented on all operating systems should cover for it.

The Plus500 trading app makes sure a trader has access to his/her trading account all the time and there’s no need to login to a PC or desktop to actually close or open a position. Smartphones make the life of a trader much easier as analysis can be made on PC while the actual trading can very well be done from a smartphone or tablet as they allow a super-easy connection and trade execution.

Depositing and Withdrawing Funds With Plus500

Upon opening an account with this broker, deposits can be made via the classical channels, like wire transfer, credit cards or via e-wallets like WebMoney, Neteller, Skrill, etc. In the case of a wire transfer, it should be taken into account that it may take up to three business days for the money to be seen in the trading account.

From this point of view, we can safely assume a Plus500 review will pass with high grades as funding methods correspond to all needs. Withdrawals are usually processed within 24 hours and the take taken for completion differs very much based on the withdrawal method chosen.

Customer Support With Plus500

Customer support is well represented as the most important feature is present: a live online chat option. This is by far the easiest way to get in contact with company’s representatives when in need for either an information or when a problem appears. Unfortunately, not all forex brokers are offering this kind of services even though it is proved to be the most efficient way to serve a problem that may arise either with the documentation necessary for opening an account or with depositing or withdrawing money.

Types of Trading Accounts

Both beginners and experienced traders are welcome to trade with this broker as a Plus500 demo trading account to test services and execution is offered. This is a must for any forex broker and Plus500 is no different, providing what is needed for testing before trading with a real account. This is a positive thing from a trader’s point of view as well as it gets familiar with the trading platform and general trading conditions offered. Trading on a demo account for a period of time until opening a live account allows a trader to see how spreads vary in different market conditions, how high volatility events are passed, etc. All in all, trading on a demo account is a must before trading live, so the very existence of a demo account in the broker’s offer should be viewed as a plus.

Plus500 Trading Platforms

There are no multiple account types and this is awesome as it means the same conditions are being offered to all traders when it comes to spreads involved, commissions, executions, etc. This is important as other brokers offer different conditions for different trading accounts and of course that the best conditions are offered by the accounts that are the most difficult to be opened.

- The process of opening an account is a standard one, with standard period for documents verification and this adds more value to the broker’s services as well.

- It is worth mentioning here that this broker offers segregated accounts, meaning funds are not used for other purposes and are guaranteed up to a specific amount by the regulatory body.

- Usually, they are placed under the trust of a commercial bank that is guaranteeing their safety as well.

For a trader, funds security is a stringent problem and segregation means that a custodian bank has the funds, not the actual broker. Those funds cannot be touched and used by the broker for other purposes like paying other withdrawals with the incoming money from new deposits. This is a result of strong regulation in order to avoid any fraud and future Ponzi schemes.

Plus500 Summary

All in all, the Plus500 broker seems to be a solid one, with a lot of experience in the retail online trading environment and most likely in those eight years since it is active in the trading environment, a lot of difficulties were overcome.

From this point of view, any Plus500 feedback is most likely to be a positive one, not to mention that attributes like professionalisms, experience, easy access conditions, segregated accounts, funds safety, friendly website and fabulous customer support, etc. are pointing to a positive review as well.