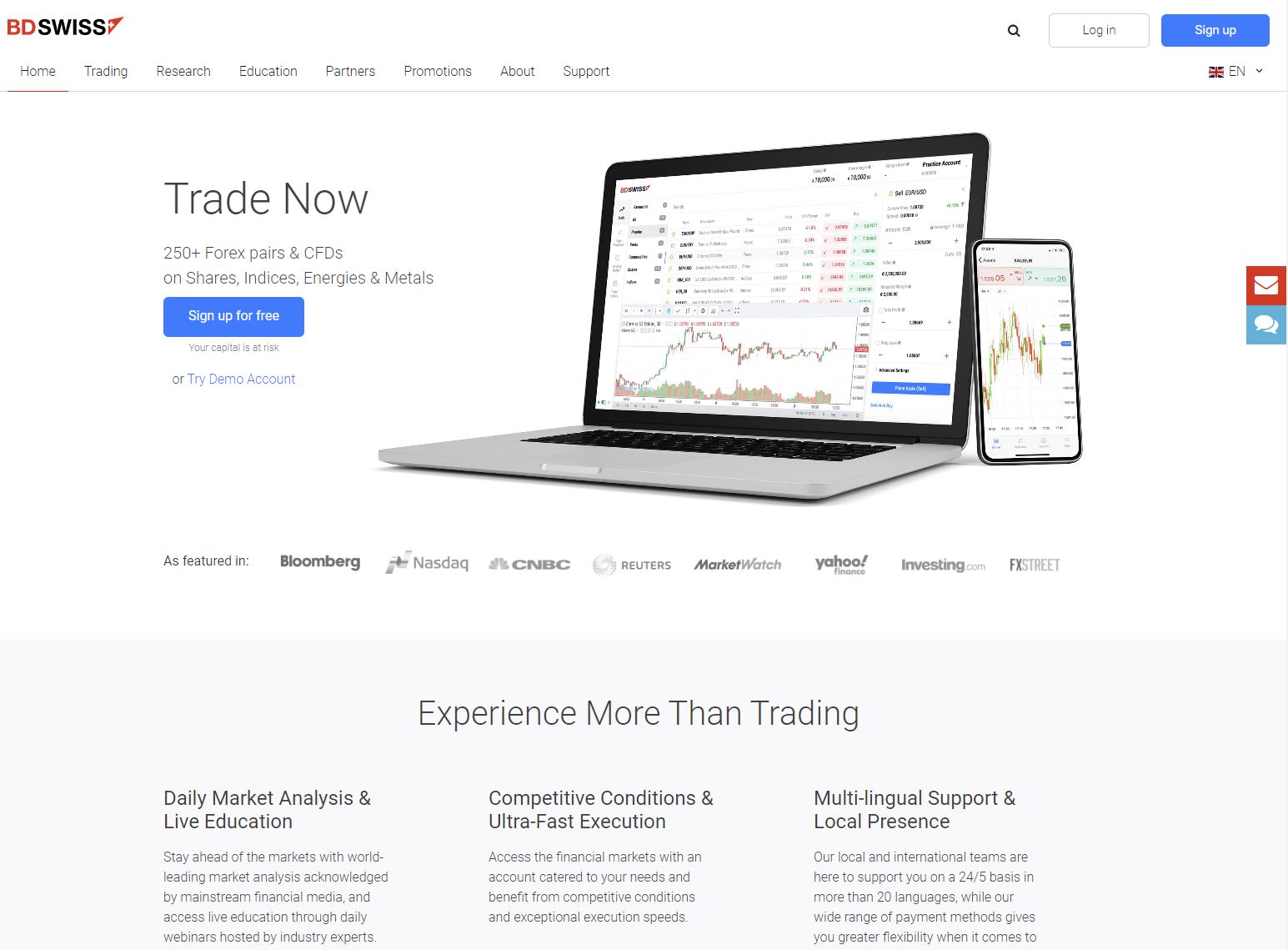

BDswiss Review 2024: Pros, Cons & Trustworthy Broker Insights

BDSwiss, a renowned forex broker and CFD provider, has established itself as a leading broker in the financial industry. Since its establishment in 2012, BDSwiss has grown significantly, offering a wide range of financial instruments, including forex trades, commodities, cryptocurrencies, and more. This BDSwiss review 2024 aims to provide traders with an in-depth look at what BDSwiss offers, focusing on its platforms, account types, and trading conditions.

BDSwiss Broker Review 2024 in Brief

- Mobile Trading: BDSwiss offers an advanced mobile app for both iOS and Android devices, enabling traders to access their accounts and trade on the go with ease.

- Demo Account: Provides a risk-free environment for traders to practice their strategies with virtual funds before trading with real money.

- Broker Provides: Comprehensive trading solutions, including a wide range of financial instruments such as forex, CFDs on commodities, indices, and cryptocurrencies.

- Best Broker: BDSwiss is often recognized as one of the best brokers in the market, thanks to its reliable trading platforms, competitive spreads, and customer service.

- Broker’s Commitment: Dedicated to offering secure and transparent trading experiences, underscored by robust regulatory compliance across multiple jurisdictions.

- CFD Broker: Specializes in offering Contract for Difference (CFDs) trading, allowing traders to speculate on the price movements of various asset classes without owning the underlying assets.

- BDSwiss Customer Support: Available 24/5, providing timely and helpful assistance through live chat, email, and phone support to address any queries or issues.

- BDSwiss Stands Out: For its commitment to enhancing the trading experience through continuous innovation and the introduction of new features and trading tools.

- BDSwiss Strives: To empower traders with comprehensive educational resources, including webinars, tutorials, and in-depth market analysis.

- Established in 2012: BDSwiss has a proven track record of reliability and has grown to become a leading broker in the industry over the past decade.

- BDSwiss Safe: Implements stringent security measures to protect clients’ funds and personal information, ensuring a secure trading environment.

- BDSwiss Continues: To expand its global presence and enhance its offerings, adapting to the evolving needs of traders worldwide.

- Offered by the Broker: A diverse range of account types tailored to meet the needs of different traders, from beginners to seasoned professionals.

- BDSwiss Provides a Range: Of trading platforms, including the proprietary BDSwiss WebTrader and mobile app, as well as the widely-used MetaTrader 4 and MetaTrader 5 platforms, catering to the preferences of all traders.

Regulatory Compliance and Security

Regulated by multiple authorities, including CySEC, FSC, and the FSA of Mauritius, BDSwiss maintains a high level of security and compliance. This broker is regulated stringently, ensuring that traders’ funds are secure and that trading practices are fair and transparent. BDSwiss does not accommodate traders from countries where it is not authorized to operate, underscoring its commitment to regulatory compliance.

Trading Platforms and Tools

BDSwiss provides access to popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary BDSwiss WebTrader. These platforms cater to the needs of various traders, from beginners to experienced professionals, by offering advanced charting tools, indicators, and dynamic leverage options. The broker also provides a range of webinars and educational resources to enhance the trading experience.

Compare BDSwiss Account Types, Minimum Deposit and Withdrawal Options

BDSwiss offers several account types, including the Classic Account, VIP Account, and Raw Account, each designed to meet the diverse needs of its clientele. Traders can benefit from competitive spreads, maximum leverage, and access to a wide array of asset classes. BDSwiss’s trading conditions are tailored to accommodate both novice and seasoned traders, providing a solid foundation for trading CFDs and forex market pairs.

BDSwiss has tailored its financial services to accommodate a wide range of traders, from novices to experienced professionals. Understanding the minimum deposit and the variety of withdrawal options available is crucial for traders considering opening an account with BDSwiss. This segment of the BDSwiss review 2024 delves into these aspects, providing traders with essential information to make informed decisions.

Minimum Deposit

The minimum deposit requirement at BDSwiss varies depending on the account type a trader chooses. Generally, BDSwiss aims to keep entry barriers low to encourage participation from all trader levels:

- Classic Account: Typically offers a relatively low minimum deposit, making it accessible for beginners.

- VIP Account: Requires a higher minimum deposit, reflecting its advanced features and lower spreads.

- Raw Account: Designed for more seasoned traders, this account might have a higher minimum deposit due to its raw spreads and commission-based structure.

BDSwiss has established these deposit requirements to cater to the diverse needs and trading styles of its clientele, ensuring there’s an account with BDSwiss for every type of trader.

Withdrawal Options

BDSwiss prides itself on providing a smooth and efficient deposit and withdrawal process. The broker offers several withdrawal options to ensure that traders can access their funds conveniently:

- Bank Wire: A secure method for transferring large amounts of money, though it might take a few days to process.

- Credit/Debit Cards: Offers a quick and convenient way to withdraw funds, with processing times shorter than bank wires.

- E-Wallets: Including popular options like PayPal, Skrill, and Neteller, providing fast and efficient withdrawals.

Customer Support and Resources at this Forex Broker

BDSwiss places a strong emphasis on providing exceptional customer support and a wealth of resources to ensure that traders have a supportive and informative trading experience. This commitment is reflected in several key aspects of their service:

- 24/5 Customer Support: BDSwiss offers round-the-clock support during the trading week, allowing traders to get assistance whenever they need it. This includes access to a knowledgeable support team via live chat, email, and phone, ensuring that traders can resolve issues and get answers to their questions in a timely manner.

- Multilingual Support: Understanding the global nature of trading, BDSwiss provides customer support in multiple languages. This makes it easier for traders around the world to communicate effectively and receive the help they need in their preferred language.

- Educational Resources: BDSwiss is committed to educating its traders, offering a comprehensive range of educational materials. This includes webinars, seminars, eBooks, and detailed market analysis. These resources are designed to help traders of all levels improve their trading skills and understanding of the markets.

- Dedicated Account Managers: Traders at BDSwiss can benefit from the personalized support of dedicated account managers. These professionals offer tailored advice and assistance, helping traders navigate their trading journey and make the most of the opportunities in the markets.

- FAQ and Help Center: BDSwiss maintains an extensive FAQ section and Help Center on their website, providing answers to common questions and detailed information on a wide range of topics. This is a valuable resource for traders seeking quick solutions and insights.

- Trading Tools and Analysis: Beyond customer support, BDSwiss provides traders with advanced trading tools and analysis. This includes technical analysis tools, economic calendars, and news feeds directly accessible through their trading platforms. These tools are crucial for making informed trading decisions.

- Community and Social Media: BDSwiss has a strong presence on social media and offers a community-oriented approach. Traders can follow BDSwiss on platforms like Twitter, Facebook, and Instagram for the latest updates, insights, and engagement with the broker and other traders.

- Security and Regulation: Ensuring the safety of client funds and personal information is a top priority for BDSwiss. The broker adheres to strict regulatory standards set by reputable authorities such as CySEC, FSC, and the FSA of Mauritius. This regulatory compliance underscores their commitment to providing a safe and trustworthy trading environment.

BDSwiss Mobile App and Web Trading

The proprietary BDSwiss Mobile App is designed to provide traders with the ultimate trading experience directly from their smartphones. It combines advanced trading features with user-friendly functionality, ensuring that traders can manage their accounts, execute trades, and analyze the markets on the go.

Key Features:

- Real-time Market Data: Stay updated with live quotes, charts, and news.

- Full Trading Functionality: Open, modify, and close trades directly from the app.

- Interactive Charts: Access a wide range of technical indicators and drawing tools.

- Account Management: Deposit and withdraw funds, view transaction history, and manage your account settings with ease.

The BDSwiss App is available for both iOS and Android devices, offering seamless integration with your trading account and ensuring that you never miss a trading opportunity, no matter where you are.

BDSwiss WebTrader: Accessible Web-Based Trading

For traders who prefer not to download additional software, the BDSwiss WebTrader platform provides a powerful, web-based trading solution. It offers a comprehensive trading experience that can be accessed directly from a web browser, eliminating the need for any installations.

Key Features:

- User-Friendly Interface: Designed for both novice and experienced traders, offering intuitive navigation and quick access to trading tools.

- Advanced Charting Tools: Comprehensive charting capabilities with customizable indicators to analyze market trends.

- One-Click Trading: Execute trades quickly and efficiently with one-click trading functionality.

- Multi-Asset Trading: Trade a variety of asset classes, including forex, CFDs on commodities, indices, and cryptocurrencies, all from one platform.

BDSwiss’s WebTrader is optimized for performance, ensuring fast and reliable access to the markets. It’s an ideal platform for traders who value flexibility and accessibility, without compromising on trading power and efficiency.

Integration with MetaTrader Platforms

In addition to its proprietary platforms, BDSwiss also offers integration with the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are known for their robust trading tools, advanced charting capabilities, and automated trading options via Expert Advisors (EAs). Traders can seamlessly switch between BDSwiss Mobile, WebTrader, MT4, and MT5, enjoying a cohesive trading experience across all devices.

BDSwiss Safe Demo Account

In 2024, a demo account remains a critical feature for traders looking to explore the forex and CFD markets without the risk of losing real money. BDSwiss, recognizing the value of such a tool, offers a comprehensive demo account designed to simulate real trading conditions as closely as possible. Here’s what traders can expect from the BDSwiss demo account in 2024:

- Realistic Trading Environment: The BDSwiss demo account provides a virtual trading platform that mirrors the real market conditions. This includes live price feeds, access to the same financial instruments available on the live platform, and the ability to test trading strategies in real-time.

- Risk-Free Learning: With a substantial virtual fund, traders can experiment with different trading strategies, learn how to use various trading tools, and familiarize themselves with the platform’s features without any financial risk.

- Access to Trading Platforms: Users of the BDSwiss demo account have access to the same trading platforms as live account holders, including the popular MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the BDSwiss WebTrader. This allows for a seamless transition from demo to live trading when the trader is ready.

- Educational Resources: BDSwiss provides a wealth of educational materials, including webinars, seminars, eBooks, and video tutorials, which are also accessible to demo account users. These resources are invaluable for beginners and experienced traders looking to enhance their trading knowledge.

- No Time Limit: Unlike many brokers that limit the use of their demo accounts to a specific period, BDSwiss offers an unlimited demo account. This means traders can use the demo account for as long as they need to build their confidence and trading skills before stepping into the live markets.

- Support and Guidance: Demo account users have access to BDSwiss’s customer support and can benefit from guidance and answers to their queries, just like live account holders. This ensures a comprehensive learning experience, supported by expert advice.

- Ease of Setup: Setting up a demo account with BDSwiss is straightforward and quick. Traders simply need to register on the BDSwiss website, providing minimal information, and they can start using the demo account almost immediately.

- Transition to Live Trading: When traders feel confident in their trading strategy and familiar with the platform, transitioning from a demo account to a live trading account is straightforward. BDSwiss ensures this process is smooth, with various account types and deposit options to suit different trading styles and budgets.

Frequently Asked Questions

What types of trading accounts does BDSwiss provide?

BDSwiss offers trading account options, for beginners experienced traders and VIP clients. These accounts come with trading conditions, including low spreads and variable spreads to cater to a wide range of trading experiences and requirements.

What is the minimum initial deposit required to open an account with BDSwiss?

The initial deposit amount required to open a BDSwiss trading account depends on the chosen account type. Each account offers its features and benefits designed to accommodate different trading skills and preferences.

What instruments can I trade with BDSwiss?

BDSwiss provides traders with a selection of tradable instruments. These include currency pairs, contracts for differences (CFDs) gold pairs and crypto pairs. This extensive range of options allows traders to explore market conditions and seize trading opportunities.

How can I enhance my trading skills and knowledge with BDSwiss?

To support traders in their journey towards improvement BDSwiss offers a trading academy. The academy includes webinars, daily videos, informative trading talks well as an introductory course for novice traders. Additionally tools such, as the calendar, trading calculators trends analysis tools. Daily market analysis are available to help you refine your trading skills.

What are the options, for withdrawing funds and what are the associated fees at BDSwiss?

BDSwiss provides methods for withdrawing funds, including Skrill, Neteller and bank wire transfers. The fees for withdrawals depend on factors such as the chosen method, withdrawal amount and account type.

How long does it usually take to process withdrawal requests?

Withdrawal requests typically take a business days to process depending on the payment processor and chosen withdrawal method. Some methods may require time due to requirements like licenses, proof of residence or identity verification.

Could you please provide information about the trading fees and average spread at BDSwiss?

Trading fees at BDSwiss vary based on the account type and trading activity. They offer pricing structures for both beginners and experienced traders. The average spread fluctuates depending on market volatility and trading instruments.

What online trading platforms and apps does BDSwiss offer?

The broker offers a range of trading platforms tailored to meet the needs of traders. One popular option is the BDSwiss app which provides real time trading alerts and quick trade execution. These platforms cater to both novice traders and active participants, in the market.

How does BDSwiss prioritize the safety of client funds. Ensure client protection?

BDSwiss Holding PLC takes measures to safeguard client funds by maintaining accounts and adhering to strict regulatory licenses. Operating under license number SD047 they also collaborate with payment processors and financial service providers to provide client protection.

Are there any services and support, for BDSwiss clients?

Absolutely! It offers a range of services to enhance the trading experience. These include the VPS Service, which improves trading performance Trading Central for market research and an affiliate program for partnership opportunities.

What is the minimum withdrawal amount required at BDSwiss?

The minimum withdrawal amount at BDSwiss varies depending on your chosen withdrawal method and account type. It is crucial to review the withdrawal options along with their requirements before submitting a request to ensure a process.

How can I make use of the BDSwiss app?

The user friendly interface of the BDSwiss app allows for execution of trades access to trading calculators and real time monitoring of market trends through trend analysis. This handy tool is perfect for traders seeking trading experiences while, on the go.

Are there any fees, for deposits or bonuses offered by BDSwiss Holding?

BDSwiss Holding might provide bonuses for deposits to encourage clients or reward customers. The specific deposit fees, if applicable, depend on the chosen payment method and the type of account. It is advisable to review the fee structure associated with each deposit method before proceeding with a transaction.

What services and support can I expect from BDSwiss ?

Alongside their main services it offers various additional financial services. These include access to VPS Service, for trading performance variable spreads that cater to trading strategies and ongoing customer support to ensure a satisfactory trading experience.

References & Further Reading

- BDSwiss. (n.d.). About BDSwiss. Retrieved from https://global.bdswiss.com/about-us/

- BDSwiss. (n.d.). Trading Products. Retrieved from https://global.bdswiss.com

- BDSwiss. (n.d.). Account Types. Retrieved from https://global.bdswiss.com/account-types/

- BDSwiss. (n.d.). Getting Started with the BDSwiss WebTrader. Retrieved from https://global.bdswiss.com/getting-started-webtrader/

- TradingBrokers.com. (2024). BDSwiss Review 2024 – Pros and Cons Disclosed. Retrieved from https://tradingbrokers.com/bdswiss-review/

- Investing.com. (2024). BDSwiss Review 2024. Retrieved from https://www.investing.com/brokers/bdswiss/review

- DayTrading.com. (2024). BDSwiss Review 2024 | Must Read Ratings | Demo, MT4 & Deposit Info. Retrieved from https://www.daytrading.com/bdswiss

- TrustedBrokers.co.uk. (2024). BDSwiss Review 02/2024: A Must Read Before Trading. Retrieved from https://www.trustedbrokers.co.uk/brokers/bdswiss-review

- Investopedia. (n.d.). Forex Trading: A Beginner’s Guide. Retrieved from https://www.investopedia.com/articles/forex/11/why-trade-forex.asp

- Babypips. (n.d.). How to Trade Forex. Retrieved from https://www.babypips.com/learn/forex